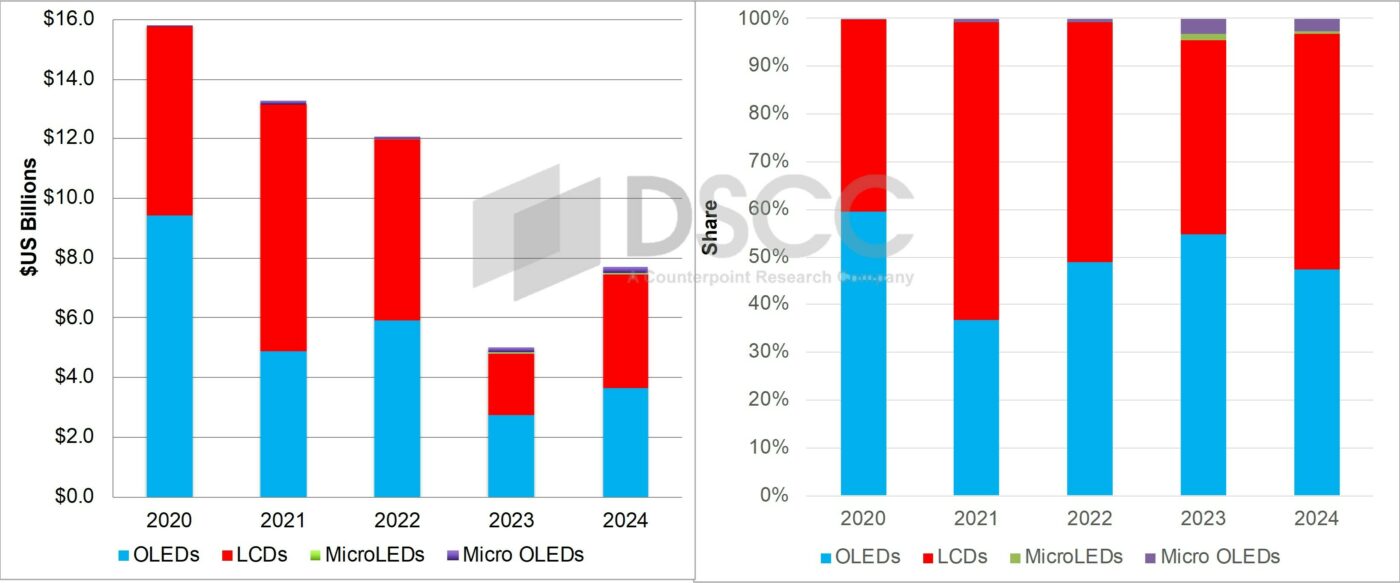

After falling 59% in 2023, display equipment spending is expected to rebound in 2024, growing 54% to $7.7B. LCD spending is expected to outpace OLED equipment spending at $3.8B vs. $3.7B accounting for a 49% to 47% advantage with Micro OLEDs and MicroLEDs accounting for the remainder.

In 2024, Samsung Display’s G8.7 IT OLED fab, A6, will account for the highest spending with a 30% share followed by Tianma’s TM19 G8.6 LCD fab with a 25% share and China Star’s t9 G8.6 LCD fab with a 12% share and BOE’s G6 LTPS LCD fab B20 with a 9% share. In total, Samsung Display is expected to lead in 2024 display equipment spending with a 31% share followed by Tianma at 28% and BOE at 16%. DSCC’s latest forecasts out fab schedules by display technology through 2028.

Canon/Tokki is expected to lead with a 13.4% share on a delivery basis with their revenues up 100% to over $1B, leading the FMM VTE segment and #2 in exposure. Applied Materials is expected to hold the #2 position with an 8.4% share on 60% growth leading in CVD, TFE CVD, backplane ITO/IGZO sputtering and CF sputtering and 2nd in SEMs. Nikon, TEL and V Technology are expected to round out the top 5. Half of the top 15 are expected to enjoy over 100% growth in display equipment revenues.

IT fabs are expected to account for 78% of 2024 display equipment spending, up from 38%. Mobile is expected to account for the next highest share at 16%, down from 58%.

Oxide is expected to lead in 2024 equipment spending by backplane with a 43% share, up from 2% followed by a-Si, LTPO, LTPS and CMOS.

By region, China is expected to lead with a 67% share, down from 83%, followed by Korea with a 32% share, up from 2%.

Post time: May-20-2024