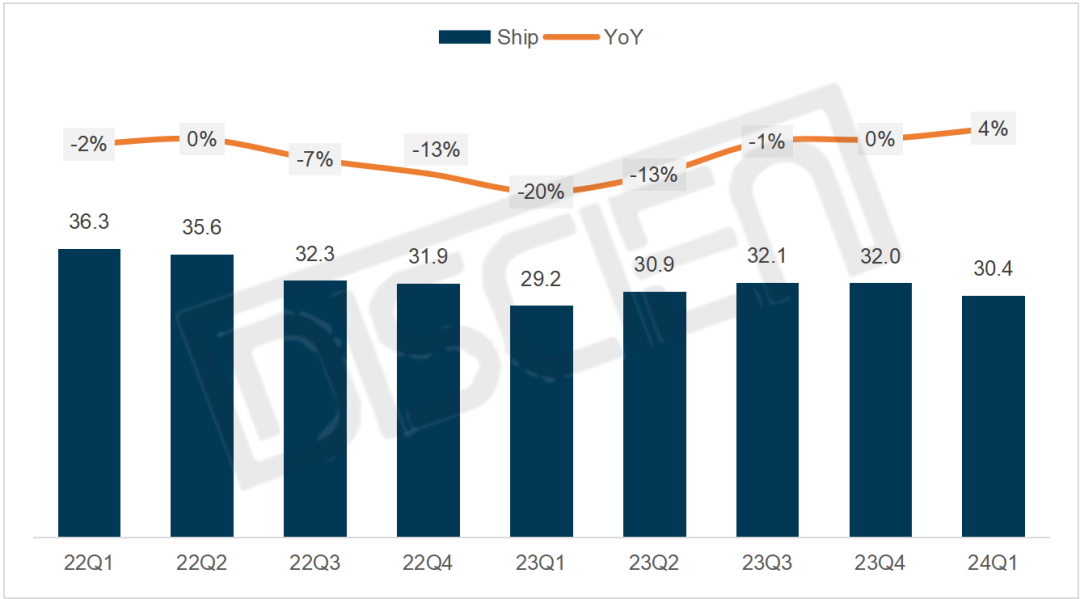

Despite being in the traditional off-season for shipments, global brand monitor shipments still saw a slight increase in Q1, with shipments of 30.4 million units and a year-on-year increase of 4%

This was mainly due to the suspension of interest rate hikes and a decline in inflation in the European and American regions. This led to a significant increase in investment in technology companies, which led to a notable strengthening of demand in the B2B market. At the same time, factors such as government subsidies to residents, AI electronic products stimulating consumer demand, and the excitement of the Saudi Esports World Cup also contributed to a robust momentum in the B2C market.

The growth momentum mainly came from the increased demand for gaming monitors, reaching 6.3 million units in Q1, a year-on-year increase of 26%, and the proportion of total shipments rising from 17% to 21%.

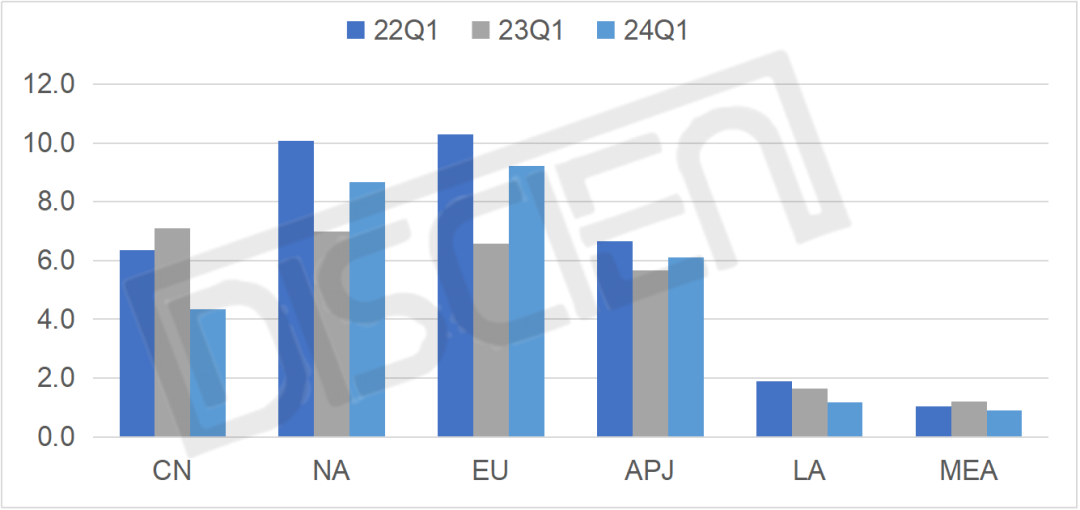

From a regional market perspective, China shipped 4.4 million units, a year-on-year decrease of 39%. North America shipped 8.7 million units, a year-on-year increase of 24%. Europe shipped 9.2 million units, a year-on-year increase of 40%.

Thanks to the favorable rebound in the European and American markets, the performance of monitor brand shipments was stable in the first quarter. Among them, the growth rate of esports products was particularly significant. The B2B commercial market in Europe and America is expected to recover this year, and the esports B2C market is expected to see a new round of growth driven by events, making the overall outlook for 2024 stronger than the previous year.

However, the current supply and demand tug-of-war is still intensifying. With panel manufacturers implementing demand-controlled production strategies, panel prices are rising, and the resulting increase in costs is leading to a synchronized increase in end-product prices, which may hurt market demand.

Post time: May-09-2024