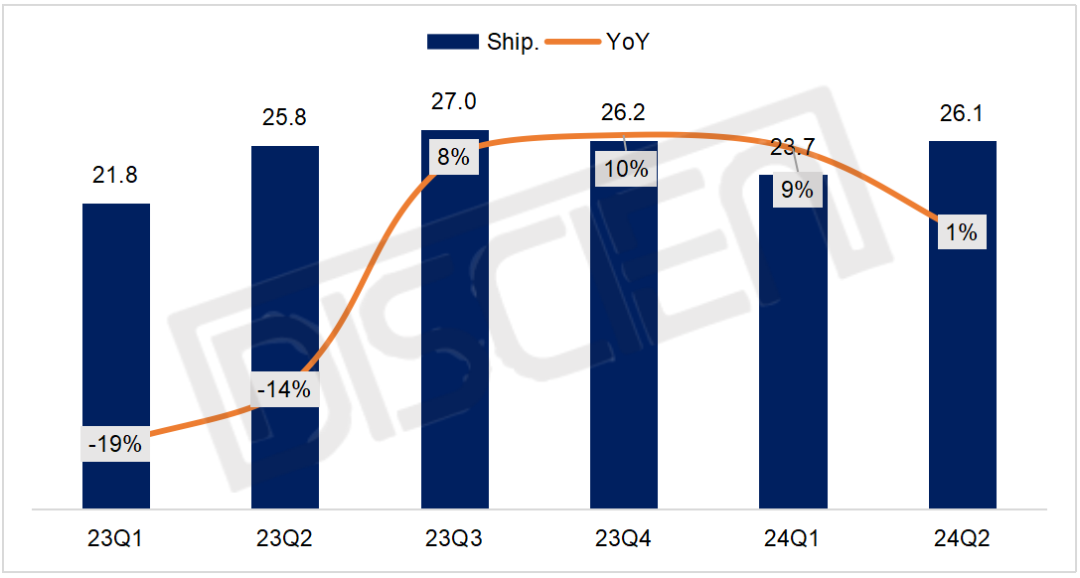

According to the statistics from the research institution DISCIEN, the global MNT OEM shipments amounted to 49.8 million units in 24H1, registering a year-on-year growth of 4%. Regarding the quarterly performance, 26.1 million units were shipped in Q2, posting a marginal year-on-year increase of 1%. Thanks to the moderate recovery of commercial demand in Europe and the United States in the first half of the year, along with the impetus of the Saudi e-sports World Cup on the global e-sports market demand, it has administered a vigorous boost to the stable growth of the MNT industry chain.

In the first half of the year, the scale of OEM maintained an overall growth trend. However, in terms of quarterly performance, the main growth was concentrated in the Q1 stage, while the growth rate narrowed in Q2. On one hand, the rise in panel prices prompted strategic purchasing by brands, driving the increase in shipments of the middle and upper reaches of the industry chain.

On the other hand, as brand purchasing demands shifted forward and due to the influence of shipping factors, the accumulated inventory in channels rose, and brands' subsequent purchasing attitudes will appropriately turn conservative.

Entering the second half of the year, the performance of overseas markets remains worthy of anticipation. Firstly, the fiscal expansion and technological innovation policies to drive economic growth in the United States will still persevere throughout the year. Secondly, the interest rate cut in Europe has been implemented, and the overall economic situation is trending positively. Once again, as time progresses into the stocking period for "Black Friday" and "Double Eleven", overseas promotional festivals are highly anticipated. Judging from the "618" event, the performance of the domestic market only witnessed a slight decline, and there are still opportunities on the consumer end in the second half of the year.

With Harris entering the U.S. presidential election, there is once again uncertainty regarding the U.S.-China trade situation. But regardless of who is ultimately elected, it is anticipated that targeted policies will be adopted for the China supply chain. For factory ends, whether the layout of overseas production capacity is comprehensive will impact the position of the future OEM pattern.

Post time: Jul-25-2024